stop on quote versus stop limit on quote

If the price of Acme shares declined to 90 but the best available transaction price at this point is only 8875 the order will not be filled since that level is. The investor has put in a stop-limit order to buy with the stop price at 45 and the limit price at 46.

Investor Bulletin Stop Stop Limit And Trailing Stop Orders Investor Gov

A trader who wants to purchase or sell the stock as quickly as possible would place a market order which would in most cases be executed immediately at or near the stocks current price of 139 white line--provided that the market.

. So if ADA hits 230 and then drops to 229 it will not sell. A Stop on Quote Order enables an investor to execute a trade at a specified price or better after the quoted stock price reaches the desired stop price. You pick a stop price of 8 and a limit.

If the price of ABC Inc. The stock is volatile so you enter a stop price of 105 and a limit price of 110. As long as the order can be filled under 46 which is the limit price the trade will be filled.

The limit order will fill as long as the shares stay below 110. If it jumps up 245 it will then have a new price of 24019 that will be the limit sell price and you would have gotten a. The stop price and the limit price.

In our first example you were sold out at 90 because once the stop was triggered it became a market order and executed at the next available price. In this article well go over why Merrill Edge decided to rename their stop order and stop limit order to. It enables an investor to have some downside.

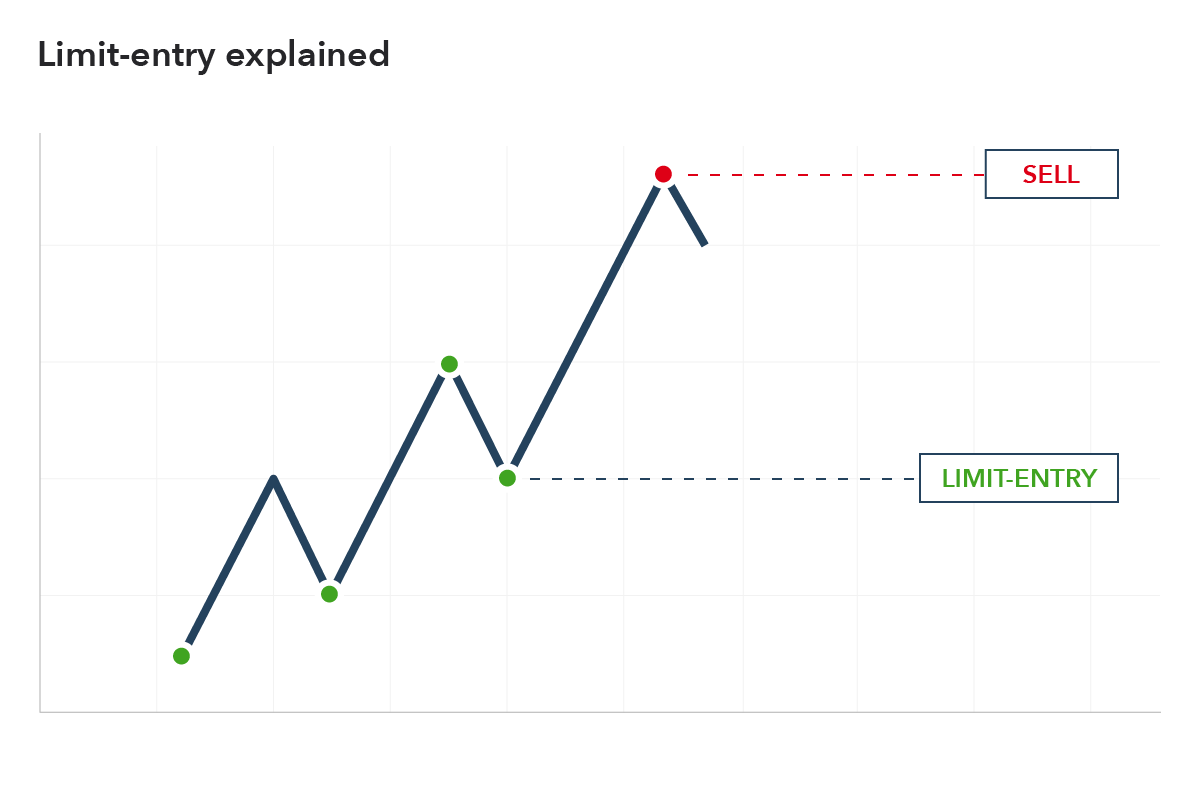

When you pass the trigger price the order goes in as a limit order. The above chart illustrates the use of market orders versus limit orders. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order.

For example a sell stop limit order with a stop price of 300 may have a limit price of 250. The stock will be sold at your limit price or better but if a buyer isnt available at the limit price the order wont be executed. It enables an investor to have some downside.

When a sell stop order triggers the market order is transmitted and you will pay the prevailing bid price in the market when received. Once the shares reach 105 the stop order will execute and trigger the limit order. For a retail trader like yourself theres no practical benefit to stop limits.

In the ABC example above a stop-limit order would look like this. At this point the stop order becomes a market order and is executed. Just use stop orders.

A stop-limit order is a trade tool that traders use to mitigate risks when buying and selling stocks. Stop limit orders are slightly more complicated. If you want 100 shares the order will begin filling at 105 but will stop if the stock quickly shoots over 110.

In this example the last trade price was roughly 139. When a sell stop order triggers the market order is transmitted and you will pay the prevailing bid price in the market when received. It is used by investors who want to limit their downside to ensure that a stock is sold before the price falls too far.

Account holders will set two prices with a stop limit order. The stop price and the limit price. When it comes to managing risk stop orders and stop-limit orders are both useful tools but they arent the same.

Stop on Quote vs. For example if the trader in the previous scenario enters a stop-limit order at 25 with a limit of 2450 the order triggers when the price. The stop price and the limit price for a stop-limit order do not have to be the same price.

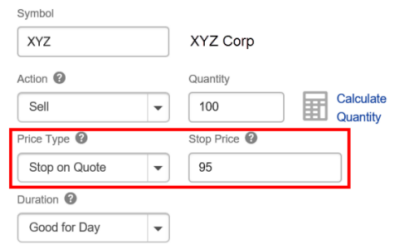

Using the stop-limit order your order is still triggered but doesnt execute unless the price rallies and hits your limit price of 95. Moves above 45 stop price the order is activated and turns into a limit order. Stop on quote orders can.

Think of the stop as a trigger that will initiate the purchasesale and the limit as a condition. In this case it works well. A stop-limit-on-quote order is basically a combination of a stop-loss order with a limit order.

Now lets break down the stop order in limit order vs stop order. Limit is an important distinction that can significantly change the outcome of your order. Buy stop orders and sell stop orders.

Stop quote orders are the same as stop orders but have been renamed by Merrill Edge in 2013 due to a FINRA rule change. When the stop price is triggered the limit order is sent to the. Join Kevin Horner to learn how each works.

When you pass the trigger price order goes in as a standard limit order. When the stop price is triggered the limit order is sent to the. A buy or sell stop quote on Merrill Edge will be executed once the market price hits the specified stop quote level.

A stop-limit order does not guarantee that a trade will be executed if the stock does not reach the specified price. Account holders will set two prices with a stop limit order. Stop limit orders are slightly more complicated.

Stop orders are of two types. Such an order would become an active limit order if market prices reach 300 however the order can only be executed at a price of 250 or better. A stop-limit order is implemented when the price of stocks reaches a specified point.

Also called a stop-loss order stop orders are used to buy or sell once the price moves past a certain point. So once ADA hits 230 it will put a limit sell order that will trail the highest price by 2.

Age Is No Barrier It S A Limitation You Put On Your Mind

Dont Worry Quote Motivation Pressplay Lyrics Lil Wayne Rap Goodlife Zitat Saying Sky Is The Limit Brave

65 No More Love Quotes About Giving Up On A Relationship

Daily Stoic On Instagram Don T Waste Time Having An Opinion About Everything Save Your Mental Bandwidth For The Things That Truly Require It Learn More About

Stop Wishing Start Doing Motivational Quotes

Getting Things Done Even If You Don T Feel Like It Havingtime

One Day Your Heart Will Stop Beating

Pin By Wendi Nix On Inspirational Quotes Inspirational Quotes Positive Quotes Change Quotes

Stop Loss Vs Stop Limit Order What S The Difference

Limit Order Vs Stop Order Difference And Comparison Diffen

Stop Vs Limit Orders What Are The Types Of Orders In Trading

If You Are A Giver Please Know Your Limits Because The Takers Don T Have Any

Potentially Protect A Stock Position Against A Market Drop Learn More