what is a fit deduction on paycheck

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Understanding paycheck deductions What you earn based on your wages or salary is called your gross income.

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Its the amount your employer deducts from your earnings each pay period and.

. Payroll taxes and income tax. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax withheld per paycheck in 2021 if the employer uses the wage bracket method for standard withholding. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

FIT stands for federal income tax. In California the State Disability Insurance SDI could be used as a Schedule A. The federal government receiving the FIT taxes will typically use the funds to finance.

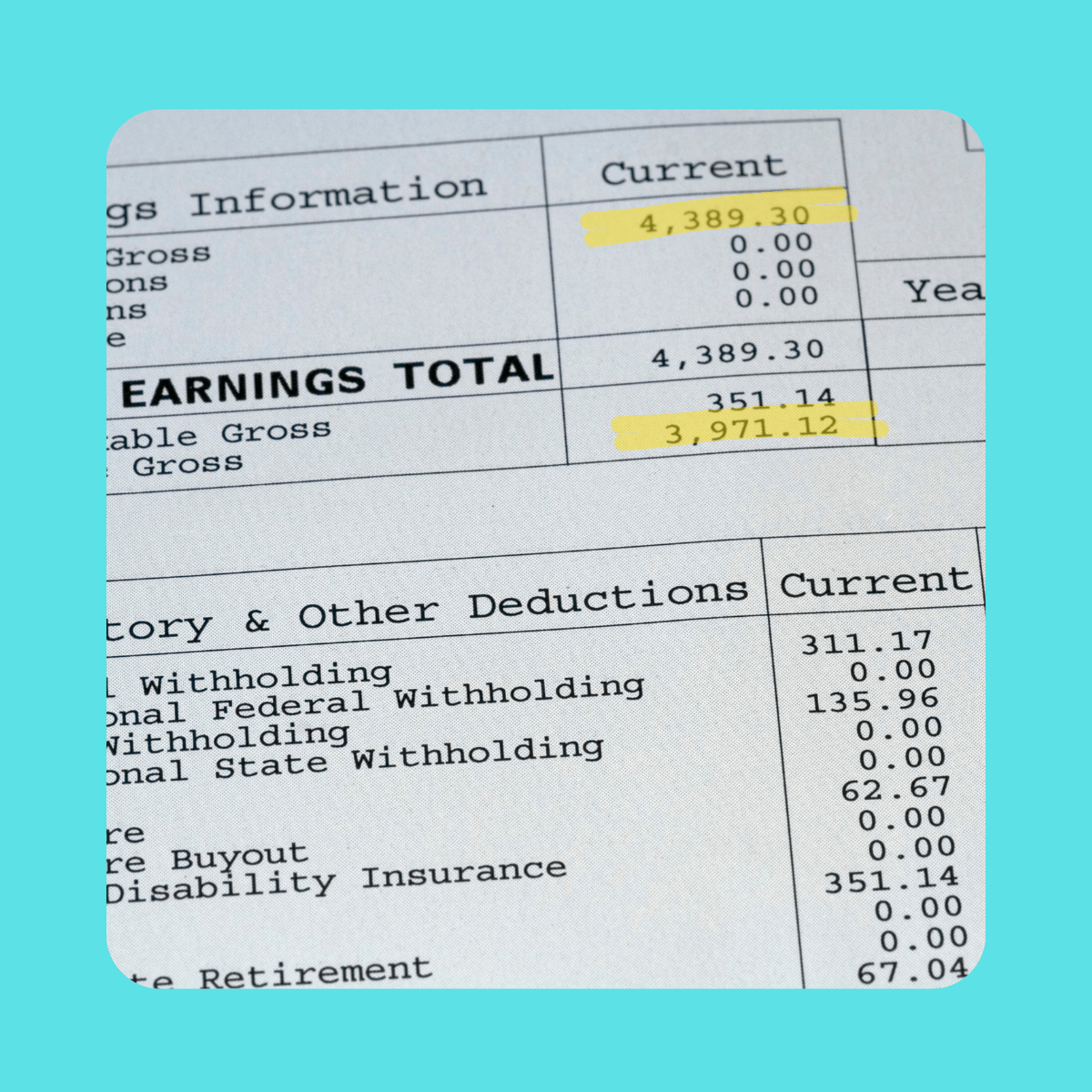

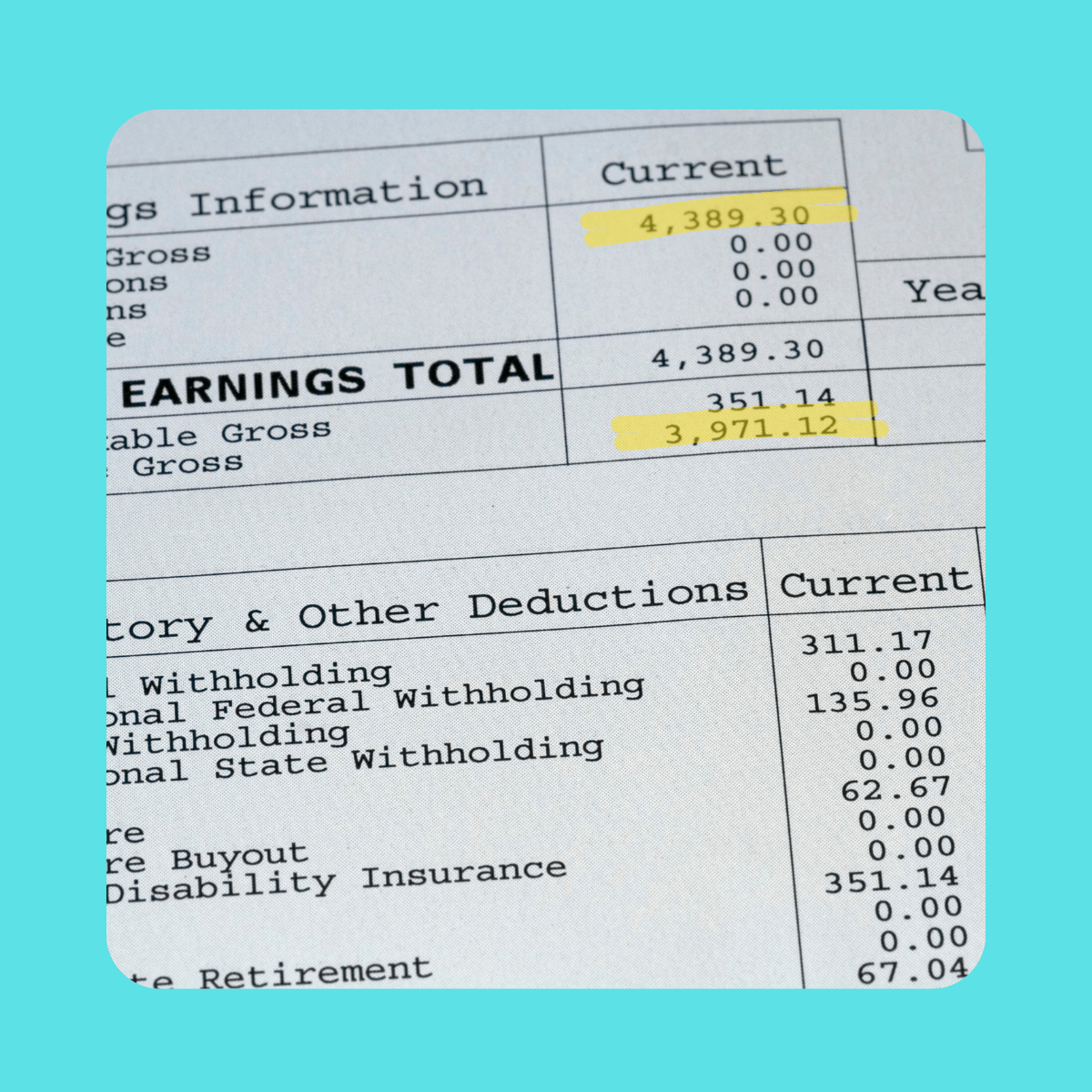

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Employers withhold or deduct some of their employees pay in order to cover. Fit deductions are typically one of the largest deductions on an earnings statement.

FIT deductions are typically one of the largest deductions on an earnings statement. FIT means federal income taxes. It covers two types of costs when you get to a retirement age.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. FIT deductions are typically one of the largest deductions on an earnings statement. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance.

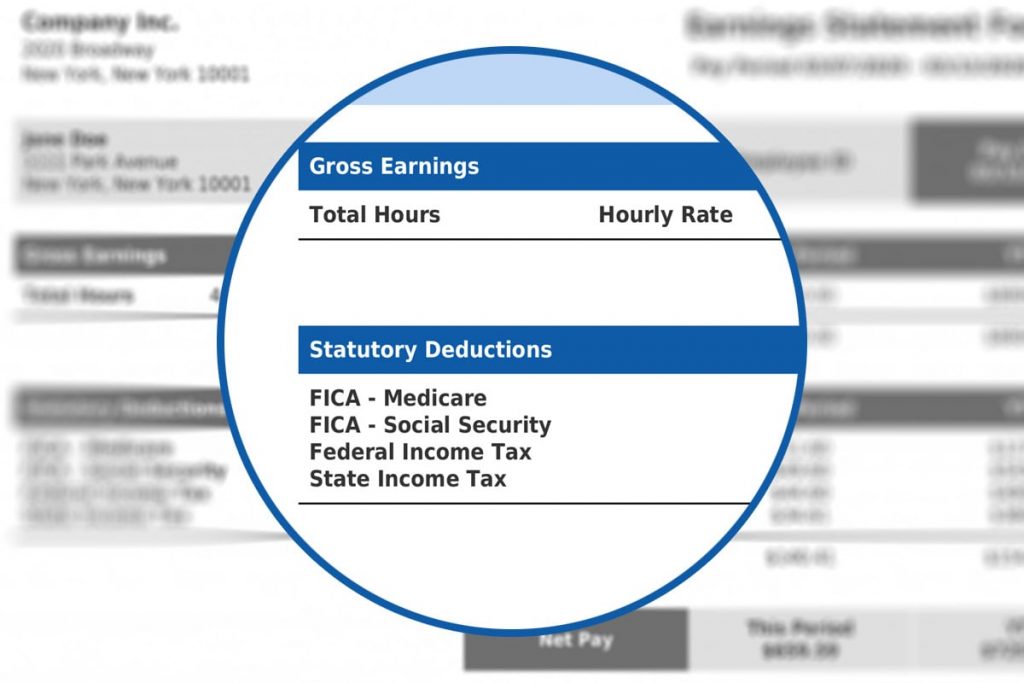

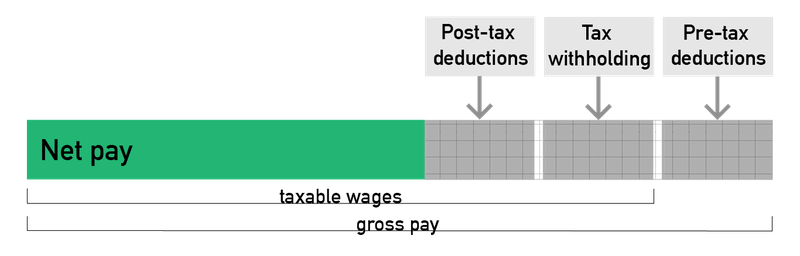

These withholdings constitute the difference between gross pay and net pay and may include. Answer 1 of 2. The last step in manually calculating fit is to add any additional withholding to the fit per pay amount.

FIT Tax refers to the federal income tax that is withheld from a W-2 employees payback on every payday. These items go on your income tax return as payments against your income tax liability. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax.

The amount of money you. The amount of FIT withholding will vary from employee to employee. Fitw stands for federal income tax withholding.

They go toward costs needed to run the federal government. Click to see full answer Similarly it is asked what is fit on my paystub. FIT deductions are typically one of the largest deductions on an earnings statement.

1 medicare and 2 social. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. TDI probably is some sort of state-level disability insurance payment eg.

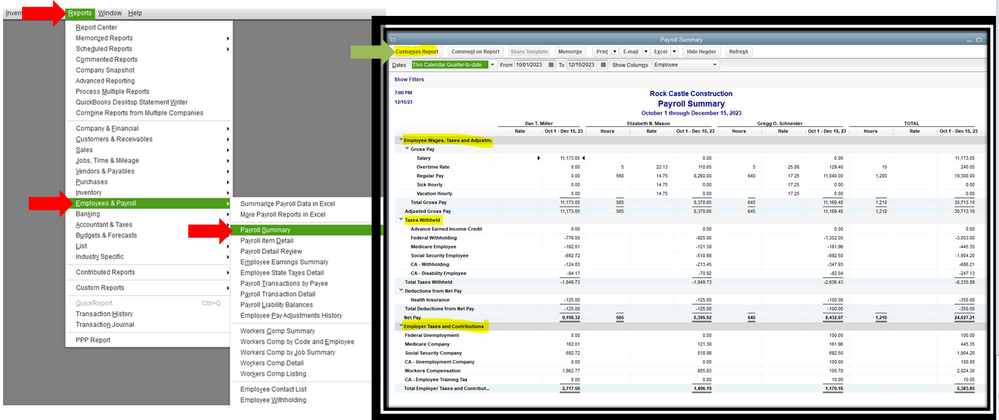

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. At tax time your employees withholding will show on their Form W-2. FICA means Federal Insurance Contribution Act.

What Are Pay Stub Deduction Codes Form Pros

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

What Everything On Your Pay Stub Means Money

Hrpaych Yeartodate Payroll Services Washington State University

What Are Pay Stub Deduction Codes Form Pros

What Is A Pay Stub Loans Canada

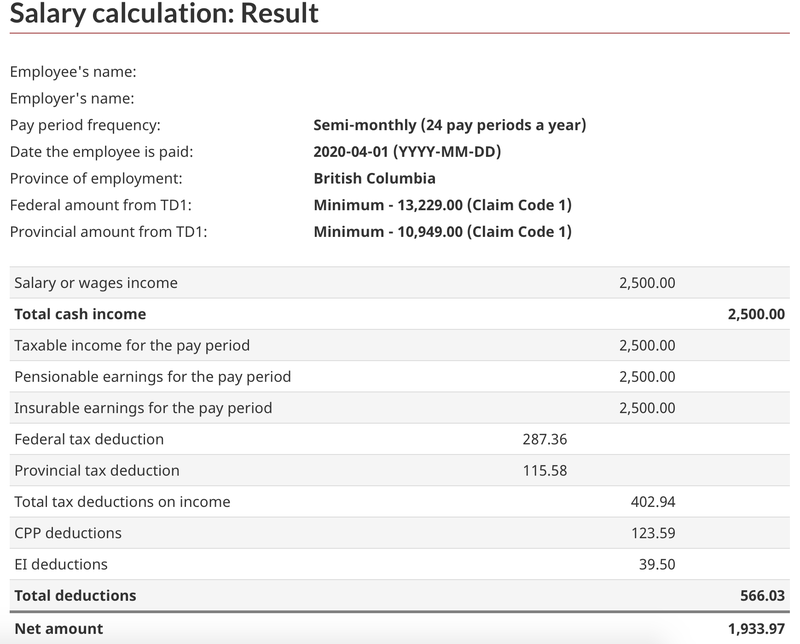

How To Do Payroll In Canada A Step By Step Guide The Blueprint

A Guide On How To Read Your Pay Stub Accupay Systems

Understanding Your Paycheck Credit Com

Pre Tax Vs Post Tax Deductions What Employers Should Know

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Federal Income Tax Fit Payroll Tax Calculation Youtube

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

A Small Business Guide To Payroll Deductions In 2022 The Blueprint

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Different Types Of Payroll Deductions Gusto

Breaking Down Paystub Deduction Codes Paystubcreator

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)